Favorite (4)

Favorite (4)

The consequences of global crises in the form of supply chain issues and rising energy prices pose a significant challenge, particularly in the high-tech sector.

In this year's economic data survey, the IVAM Microtechnology Network focused on the issue of supply chain problems. The survey investigated whether the surveyed organizations are affected by these problems and, if so, how they are responding to them, or whether national governments or the EU can offer assistance. The topic of sustainability remains of great interest, with an increasing number of organizations adopting sustainable practices, at least in some areas.

In numerical terms, 85.7% of institutes and 58.4% of companies are affected by supply chain issues. As a result, delivery deadlines cannot be met (45.5%), or there are challenges in maintaining production (16.4%). The fewest organizations are losing customers (5.5%) or experiencing a decline in revenue (7.3%).

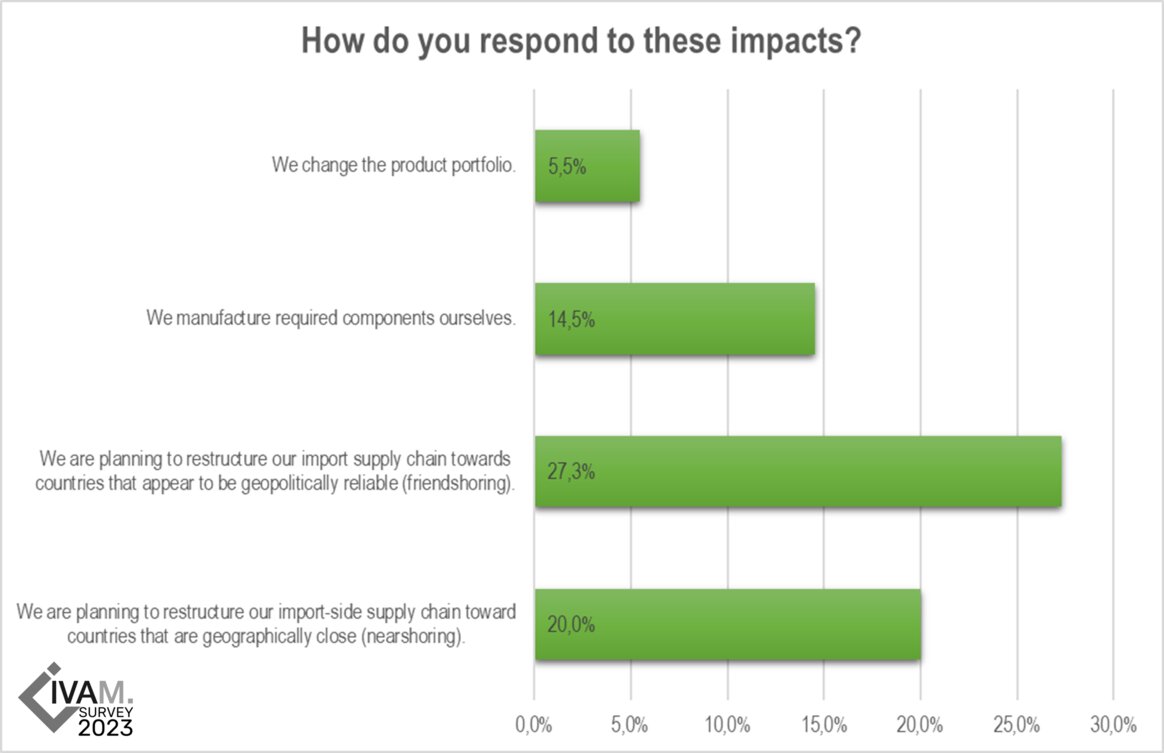

In light of supply chain challenges, a significant portion of the surveyed organizations is contemplating a strategic shift in supplier selection. Specifically, 27.3% of these entities intend to reorganize their import-side supply chain by moving away from sourcing countries characterized by high geopolitical risk, opting instead for countries deemed geopolitically reliable (friendshoring). Another 20.0% plan to transition to sourcing countries that are geographically proximate (nearshoring).

When queried about the potential role of national governments or the European Commission in addressing supply chain issues, especially through initiatives like the European Chips Act, research institutes express a positive stance. Key solutions are primarily perceived to lie in streamlining bureaucratic processes for supplier establishment, providing support for SMEs and foundries, standardizing legal frameworks, and expanding infrastructure (e.g., rail networks). However, there is a degree of skepticism regarding the competencies for implementing such support, with concerns raised about the effectiveness, direction, and scope of initiatives like the European Chips Act. Some argue that it may disproportionately benefit larger entities, while others view it as merely a symbolic gesture with limited impact.

Sustainability has become a prevalent focus among the majority of respondents within companies and institutes, with a total of 85% self-reporting varying degrees of sustainable practices. Notably, 11.3% (up from 10.9% in 2022) operate entirely sustainably, while 49.1% (an increase from 41.3% in 2022) adopt sustainability in specific areas. Additionally, 24.5% of companies are presently formulating sustainability concepts (down from 26.1% in 2022). A mere 1.9% of respondents declare a lack of current or planned sustainability efforts, a notable decrease from 6.5% in 2022.

Beyond internal efforts, organizations in the microtechnology sector actively contribute to sustainability in Germany and Europe through products and technologies designed to conserve resources, mitigate climate impact, and generate reusable materials.

Approximately 44.4% of organizations assert the relevance of their products to a sustainable or circular economy (comprising 16.7% institutes and 47.9% companies). Notably, in terms of technologies, the sector's significance is even more pronounced, with 83.3% of institutes and 29.2% of companies developing technologies that actively contribute to sustainability.

Examining specific areas of sustainability engagement, the majority of respondents are currently involved in "resource conservation" initiatives (61.1%), closely followed by efforts in achieving energy neutrality (40.7%).

.png?format=.jpg&upscale=False&x=1164)

Despite supply chain challenges, a notable 60.9% of companies experienced an increase in turnover in 2022 compared to the previous year, with 15.2% maintaining stable turnover. Similar trends are observed in employee numbers, with 49% of surveyed companies reporting an increase and 40% maintaining the status quo. However, the growth in exports was moderate, as indicated by 26.4% of companies reporting increased exports, while 35.8% saw stable export figures. This may suggest a shift in production towards inland locations, aligning with strategies like friendshoring and nearshoring in supplier selection.

The survey also revealed an optimistic outlook, with a majority of respondents anticipating growth in both turnover (71.1%) and employee numbers (63.5%) over the next three years. In terms of exports, 45.3% of companies expect an increase, while 30% foresee stable export levels in the coming years.

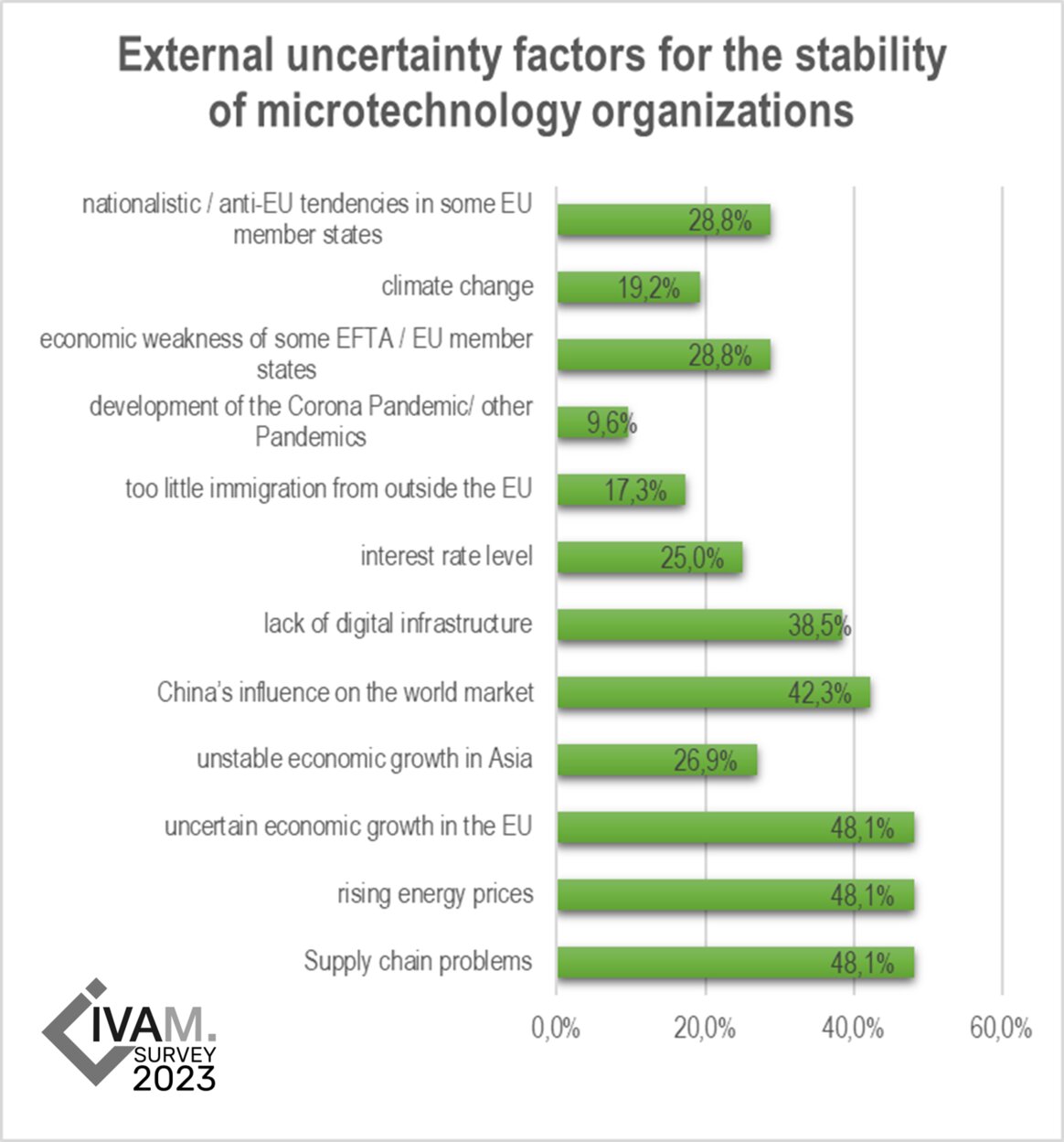

At the time of the survey, 48.1% of the organizations surveyed considered developments in the EU in particular (this includes uncertain economic development on the one hand and increasingly clear nationalist tendencies in individual EU countries on the other), rising energy prices and supply chain problems to be the greatest external uncertainty factors that could jeopardize stability in the industry. Other uncertainty factors include China's influence on the global market (42.3%) and the lack of digital infrastructure (38.5%).

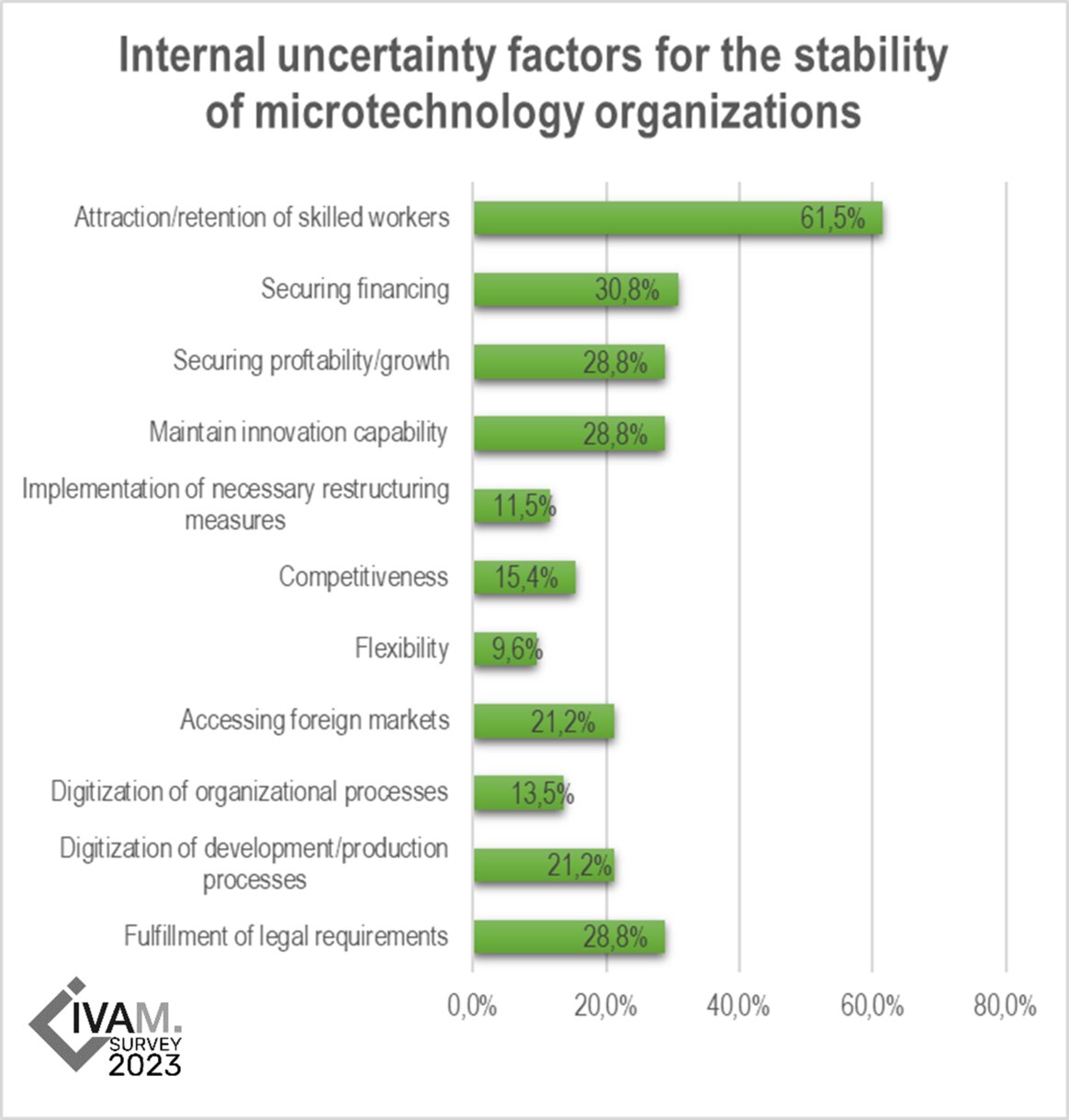

In our 2022 survey, organizations were already grappling with the challenge of sourcing and retaining qualified professionals. Since then, the percentage of organizations viewing this as an internal uncertainty factor has further increased. Now, 56.5% of companies and 100.0% of surveyed research institutions identify recruiting and retaining skilled workers as their primary internal uncertainty factor concerning development opportunities.

In addition to the factor of recruiting skilled workers, the biggest uncertainty factors for the organizations surveyed with regard to internal stability are securing financing (30.8%), securing profitability (28.8%), maintaining the ability to innovate (28.8%) and meeting legal requirements (28.8%).

Profitability and financing are always pressing issues for suppliers, some of whom are highly specialized and often deliver customer-specific solutions in small batch sizes. In view of the still uncertain development of the economic situation in the EU, these concerns are likely to increase further.

The high-tech sector faces intensified supply chain challenges and escalating energy prices amid global crises. Despite the pervasive impact of supply chain issues on the majority of microtechnology organizations, strategic measures are being planned, particularly in the realm of supplier relationships. External uncertainties encompass EU developments, mounting energy prices, and ongoing supply chain issues, while internal challenges revolve around recruitment, financing, and profitability.

Despite these hurdles, the microtechnology sector perceives itself to be fundamentally economically stable, approaching the new year of 2024 with anticipated growth in both turnover and employee numbers.

For more than ten years, the IVAM Microtechnology Network has been asking the microtechnology industry in Europe each year about its economic situation, strategies and trends. In autumn 2023, more than 3,000 companies and research institutes in Europe have been asked about their economic situation and expectations, their international activities, market and application trends, drivers for innovation, and uncertainty factors for the stability of their organization.